Activity Detail

The Impact of Indonesia's Infrastructure Delivery

Indonesia to hit 7% GDP growth by 2023 - on the back of $100bn infrastructure projects

Indonesian President Joko Widodo can achieve his economic growth target of 7% within the next five years if the $100 billion worth of infrastructure projects that are currently under construction are completed on time, a Tusk Advisory study showed.

The administration of Jokowi, as the President is known, aims to build power plants, ports and other infrastructure valued around $342 billion under its Priority and Strategic Infrastructure Programme. About $100 billion of that were under construction or completed as of December 2017.

The completion of those $100 billion projects by 2019/2020 is expected to boost Indonesia’s GDP growth rate to 7.2% by 2023, according to an independent study by Tusk Advisory, a leading regional infrastructure strategic advisory firm. If at least half of the remaining infrastructure plan is implemented, this GDP growth rate could increase further to more than 9% by 2030.

Investments in infrastructure will also significantly reduce inequality and poverty in Indonesia: By 2030, they are expected to knock two points off the country’s GINI index – a measure of inequality – and bring the poverty rate down to around 8% from 10.9% currently.

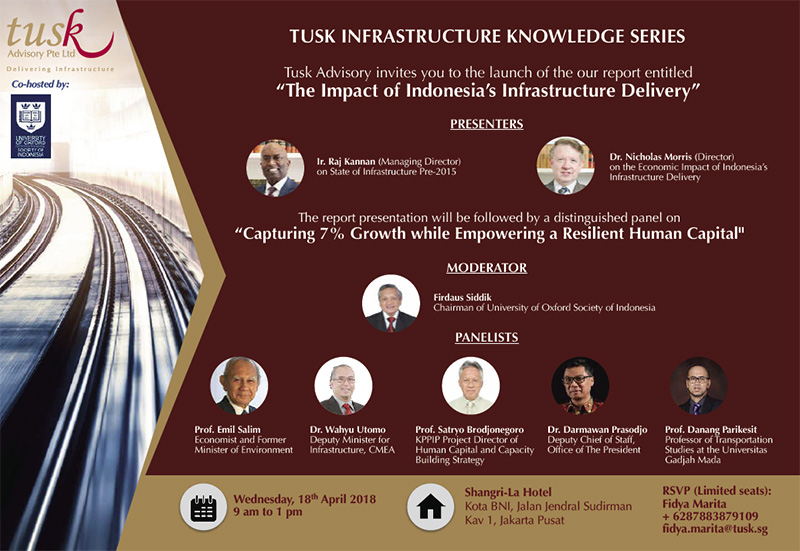

Raj Kannan, the managing director of Tusk Advisory said that “this level of infrastructure buildout is unprecedented in the last decade and when completed they are also expected to support Jokowi’s recently announced Industry 4.0 program”. “Besides the estimated uptick in the GDP growth, the reductions in poverty and inequality are clear signs that the infrastructure investment will increase financial inclusion of its people”, he said.

The Jokowi administration is not just focusing on the traditional economic powerhouses of the islands of Java and Sumatra – it is also building more infrastructure in Kalimantan, Sulawesi, Papua, and even in the small islands of Maluku. Examples are the Trans Sumatra Highway, the future infrastructure backbone of Sumatra; the construction of railways in Sulawesi; and the establishment of special economic zones in Papua. These projects show the government’s focus on equitable infrastructure development throughout the Indonesian archipelago.

While the Jokowi administration’s progress so far has been encouraging, much of the task has been taken on by a number of State-Owned Enterprises, some of which are cash-constrained. In order to achieve its full target, it is imperative that the government also consider alternative strategies to fund these SOEs as well as to harness the financial, management and technological capabilities of the private sector.

It is encouraging to note that the government is cognizant of the continued need for fresh capital and has been active in facilitating innovative funding schemes, including the historic issuance of Future Revenue Based Securities (FRBS) locally by several infrastructure SOEs. The government has also enabled watershed rupiah denominated bonds (called Komodo Bonds) on the London Stock Exchange. Furthermore, it is in the final leg of issuing new regulations to monetise some of its key infrastructure assets via Limited Concession Schemes (LCS). LCS allows the generation of fresh capital for infrastructure from the private sector, without selling any government assets.